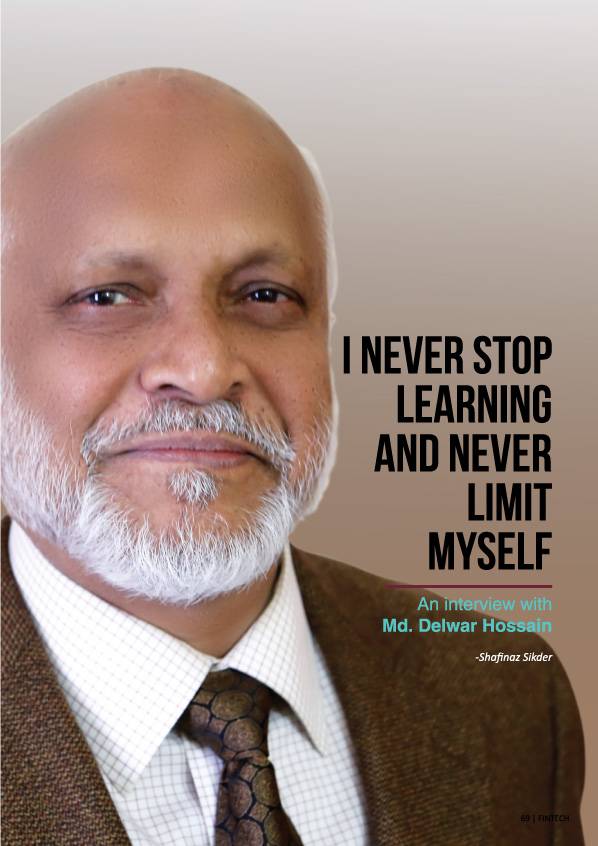

With immense passion for programming and a wealth of experience in working at the highest levels in the IT sector, nationally and internationally, Md. Delwar Hossain is amongst the first generations of IT gurus in Bangladesh.

Md. Delwar Hossain designed and developed “Simplified Nutrition Online (SNO)”, a software that is being used in more than two thousand adult living facilities, nursing homes, hospitals and correctional facilities in USA.

After completing his MBA, with major in QBA, from the Institute of Business Administration (IBA) of Dhaka University, Hossain started his IT career in 1981 as a programmer at Adamjee Jute Mills. He served as the System Analyst at the Prime Minister’s and the President’s Office from 1989 to 1994. He left the government job to pursue an ambitious and adventurous journey that would lead him from important positions in private banks to working at the top levels of software development.

We find out more in this interview with Md. Delwar Hossain.

FINTECH: You worked as a System Analyst in the President’s and Prime Minister’s Office. Why you quit that job at such an early stage of your career?

MDH: Yes, it is true that I had, what most people would call, a golden opportunity. I worked both in the President’s Office and Prime Minister’s Office as a system analyst from February 1989 to March 1994 before I realized that I needed to operate within a wider area to make full use of my knowledge on IT.

FINTECH: Could you be more specific please? What exactly made you leave the coveted government employment? And please also tell us what you did after that.

MDH: The scope to bring about changes … yes … to be more precise, I was actually keen to work somewhere else, where I can fully contribute, explore and bring about revolutionary changes.

I started my career in the banking sector by taking a position as the vice president in Islami Bank Bangladesh Ltd. and I was there for a year before leaving in April 1995. After that I accepted the  vice president position of a newly established bank, The Prime Bank Ltd, and worked there for almost two years, until February 1997. After that, when City Bank offered me a position of senior vice president, I was eager to join there to take up more challenges, as City Bank had been well established and longstanding private sector bank and had a lot of branches at that time. After working there for two years, I moved to USA.

vice president position of a newly established bank, The Prime Bank Ltd, and worked there for almost two years, until February 1997. After that, when City Bank offered me a position of senior vice president, I was eager to join there to take up more challenges, as City Bank had been well established and longstanding private sector bank and had a lot of branches at that time. After working there for two years, I moved to USA.

During my tenure at Islami Bank, I educated myself on the Islamic banking concept. Initially, I started to computerize the operation in central accounting department. One year was not enough for me to computerize their whole banking operation. During my stay in Prime Bank Ltd, we started a branch with 6 employees only. In that branch we did not have any paper “Ledger” books. Most of the operation was computerized in all of the branches during my stay in this bank. In The City Bank, at one point, I was in charge of four divisions/departments, i.e. Computer Division, Administration Division, The City Bank Training Institute and the Principal Branch. The City Bank authority was pleased with me since they found that I was capable of more than just IT responsibilities. I was interested to participate actively on other banking operations. During my managerial responsibility of the Principal Branch for a few months, I earned in-depth knowledge on the traditional banking system. Since I had a chance to be the principal of the training institute, besides providing IT training to the bankers, I had an opportunity to study the write-ups of senior bankers from different banks. All these things helped me to get into the mainstream banking system. And that was a real accomplishment for me.

FINTECH: Talk about your moving to the US. Was it difficult to move in midway through a thriving career?

MDH: It was not easy but I wouldn’t call it immensely difficult either. It is true that many people were quite perplexed at my decision; some of my friends and family even tried to stop me. They urged me to not leave Bangladesh at that age; they warned me about the problems that I might face in the way of getting a job as a middle aged foreigner. But I was optimistic and determined.

FINTECH: And what was the reason behind this determination?

MDH: I was confident about my willpower and I knew I can work hard, so it happened. I knew that I will have a wider scope for work and a lot of opportunities to enrich my IT knowledge. One of my relatives helped me to get a job in USA which in turn helped me to get H1B (working) visa. After arriving there, I was looking for a better job. Yes, for a short period I had to wait for work. I was not acquainted with the job search processes but it did not take much time for me to learn. The first job I got was in “The Daily Racing Form” located in 100 Broadway (in between Wall St and Pine St.), New York downtown. After six months there I moved to Florida and joined a software company called the Gatorbait Group LLC. I am still with this company.

MDH: I was confident about my willpower and I knew I can work hard, so it happened. I knew that I will have a wider scope for work and a lot of opportunities to enrich my IT knowledge. One of my relatives helped me to get a job in USA which in turn helped me to get H1B (working) visa. After arriving there, I was looking for a better job. Yes, for a short period I had to wait for work. I was not acquainted with the job search processes but it did not take much time for me to learn. The first job I got was in “The Daily Racing Form” located in 100 Broadway (in between Wall St and Pine St.), New York downtown. After six months there I moved to Florida and joined a software company called the Gatorbait Group LLC. I am still with this company.

FINTECH: Please tell us more about your experience in the US. What were the challenges?

MDH: It was difficult in the sense that there was an economic recession and many of the employees were the sufferer of mass layoffs. Luckily, I was not one of them because I advised my boss to develop SAAS based applications in the open source environment and commercialize them. That helped to reduce the development and implementation costs dramatically. We came up with a product known as “Simplified Nutrition Online (SNO)” and we started selling the services of that software instead of selling this software itself. This is our flagship product.

FINTECH: Talk about the problems you faced with trying to market a new IT product. Was it understood for its usefulness at first?

MDH: As you said, it was not appreciated in the beginning. In fact, we had to give this “SNO” software for free to some of the healthcare facilities. Because “SNO” did not have enough credibility and popularity in the market, as it had just start its journey. However, it gradually started to penetrate the market. When we started generating income, I was really proud of it. Over time its popularity increased dramatically in the healthcare industry. Now it is being used by more than 2000 adult living facilities, nursing homes, hospitals and correctional facilities in USA.

FINTECH: That is quite an accomplishment. Do you take a back seat now and let other work for you? What is your work pattern like?

MDH: Well, I plan is to never stop; I have decided that I will never retire. I have learned skills needed for software development. I did not limit myself and I learned the whole process involved in creating and developing a software. I have the requisite knowledge and expertise for survey, analysis, planning, designing, development, testing, implementation and monitoring. I acquired this through years of hard work. Even to this day today I am learning latest programming languages and I am doing the coding myself.

I am writing programs to keep myself updated with the latest programming techniques but also to help out the new software developers whenever they are in need. Let me make it clear that the  young software developers may have specific skills but they are still not very good in integrating the entire software development life cycle and this is where I think they need my help. For example, today our company is developing different mobile apps. ‘Nutrition Calculating Apps’ is one of them. In this app you can enter your age, height, weight and gender; and easily know about your calorie, protein and fluid requirements and other information.

young software developers may have specific skills but they are still not very good in integrating the entire software development life cycle and this is where I think they need my help. For example, today our company is developing different mobile apps. ‘Nutrition Calculating Apps’ is one of them. In this app you can enter your age, height, weight and gender; and easily know about your calorie, protein and fluid requirements and other information.

For any technical issues with the app, starting from database to other troubleshooting, the developer used to come to me for help. The thing is I always keep myself updated with the latest technology, programming languages and design and development methodologies. Now I am focusing on the overall engineering of the complete software development life cycle. I am still learning and will keep learning.

FINTECH: You are now in Bangladesh. How do you manage to work with your US office?

MDH: I had to come back to Dhaka for personal reasons and it was not very easy to convince my office as well as my family at first. But I managed to do it. I have created a virtual private network environment by configuring all the servers in a cloud environment. Then we created a secured virtual private network tunnel over the internet to work in these servers from my own laptop computer sitting anywhere in the world.

FINTECH: What are your thoughts on the current banking industry? Do you see significant changes?

MDH: Yes! big changes, I have to say. I have returned after 13 years and I was literally stunned (laughing proudly). There are ATMs and CDMs all over the country! Banks have implemented mobile banking and they have started agent banking as well. I have been thoroughly impressed. There are lots of technology based financial products and services in the market. Our government has invested a lot to make the dream of “Digital Bangladesh” come true. I must salute all of them.

FINTECH: Does the recent security breach set us back a little?

FINTECH: Does the recent security breach set us back a little?

MDH: I think the software that is being sold in the name of security is meant to earn money, to be frank. I believe security implementation method is very much a critical issue for a mission critical environment.

FINTECH: What is your advice regarding cyber security issues in the banking environment?

MDH: Think of a situation. I want to buy a flat and I end up buying a place even after seeing that the doors and windows have no locking system. Whose fault would it be? My point is, to handle security issues, you will have to make a detailed plan diligently before implementation of any software, find the loopholes to cover them up and continuously monitor all activities in the system.

FINTECH: What are the vulnerable areas and how to tackle them?

MDH:There are inside and outside security issues. Security fence is broken when you jumble up man and machine operations without proper planning. Banking environment is a mission critical environment. Security issues should be dealt with zero tolerance towards vulnerability. You cannot sit idle waiting for a security issue to arise. Your software will have to be properly configured to protect from security hazards and will have to be always ready by setting a group of knowledgeable personnel to monitor each and every activity during banking operation. You will have to do rigorous vulnerability assessments and penetration testing to protect your business information.

There are different types of servers such as database servers, application servers, load balancing servers, VPN servers, replication servers, snapshot servers, mail servers, activity monitoring servers etc. These servers use different ports. These ports need to be properly configured. User profiles must be created using secured and well tested methodology. Each and every transaction should be monitored by monitoring servers to track any exceptional data handling. When you are configuring the Central Banking System (CBS) / Central Application System / Central Database System, it should be configured based on reliability, availability, serviceability, integrity & security. Each and every transaction should be secured, verifiable and auditable. And to do all these things you need the right people behind the system. Those people should have the capability on strategic planning, tactical action, operational decision-making and coordination of people and resources to fulfill the company’s mission, vision and core objectives.

FINTECH: What are your thoughts on our youth? Do you think they have what it takes to take up the new challenges of the digital era?

MDH: I think they have immense potentials. All they need right now is proper leadership, vision and guidance. If they get that, they will be able to achieve anything. The next generation can do a lot in the IT industry. In the past we thought that jute was the next big thing. Now for the next generation(s) software development is the ‘golden fiber’.

To become a successful IT professional, you don’t need big educational certificates in IT. All you need is a passion for it and you will be good to go. Look at Bill Gates, how much formal education he had in IT? Not that much. All I can say to our young software developers is that be passionate about being a software developer, learn latest languages which are used by majority of the developers, do test driven development (TDD), learn behavior driven development (BDD), use software development methodologies like Agile, SCRUM, etc, do research on present and markers of upcoming successful software. You will see that the global market is waiting for you.

FINTECH: Thank you very much for the time.

MDH: You are welcome and thank you for speaking with me.