Digital financial inclusion for the poor is now happening nowadays but still, the consumer is facing problem on payment. While traditional microfinance and banks remain important, the potential of using new technology-based platforms to serve the poor is huge. In particular, mobile network coverage and the use of a variety of indirect channels (e.g. merchant points or agent) reduce the costs compared to more traditional full-service branches owned by banks. Cash is the main barrier to financial inclusion. As long as poor people rely on cash or barter, they remain too costly for formal financial institutions to serve. Once poor people have access to cost-effective digital means of payments, they can exit this trap and could in principle be profitably supplied by a range of financial institutions. Profitability, scale and serving poor customers are not incompatible anymore. Providers can offer not only mobile money, but also savings, credit, insurance, and other financial products to the poor at low cost.

Globally interoperability MFS, DFS, and banks are practicing and already got the impact. Interoperability is now directly depend on Technology. It allows the vast users’ request to do the required job automatically. Our proposal is focusing on technology deployment and suggesting the right regulations.

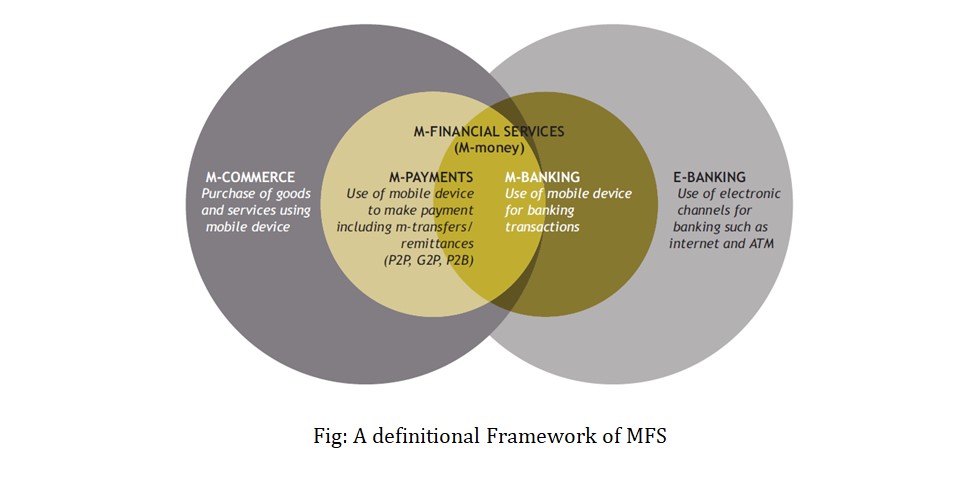

There are three key components of DFS:

(i) A digital transactional platform (Digital Wallet)

(ii) Retail agents or Merchant Point.

(iii) Use by customers and agents of a device – most commonly a mobile phone – to transact via the platform.

In practice, DFS builds upon the transactional platform that allows payment instruments (e.g. cards, mobile phones, and others) to be connected to storage accounts and allow users to make payments using any retail agent. DFS interoperability is much more than technical tools that allow modern payment systems to work together. The existence of a well-designed technology connecting payment systems alone will not ensure that interoperability will reach its full potential unless the providers are incentivized to pass payments to each other. For the purpose, interoperability must balance the conflicting interests of different providers; and probably strike a middle ground between competition and coordination. Achieving balance is one element that makes interoperability a complex issue.

Interoperability technical approach

As the interoperability is connected to the countries, all financial systems in a hub are pretty much risk regarding the security issue. For effective interoperability, some functional elements can be regulated to creating the economic value and sustainability of the system.

Technical integration:

Technical infrastructure must be in place to connect participants and transfer payments and related data through a secure platform. For this technical platform and integration, it’s now the time for Blockchain technology. Interoperability is the ability to freely share information across all blockchain networks. In a fully interoperable ecosystem, if a user from another blockchain sends you something on your blockchain, you will be able to easily recognize and interact with it.

Business agreements/incentives:

Balanced models should be made operational that can serve the economic interests of interoperability participants equitably. As the interoperability allows all providers to transaction, the market becomes more competitive and there will be more opportunities in the Business aspect. Business agreements guidelines and regulations have to be integrated with the business.

Governance of interoperability:

Agreed decision-making systems are available to manage shared processes, rules, operations and risks.

In a recent study on interoperability in 20 country markets, CGAP mentions that the focus in almost all countries is on technical connections and not on the remaining two elements (business agreements and governance) that are critical to creating volume and value. According to the CGAP study, some form of interoperability exists in each of the 20 countries; however, no country is found where all three elements are working optimally. In addition, the study notes that there is often not enough focus on governance and business agreements; and that too heavy focus on technical aspects may actually have hindered the scalability of interoperable transactions in many countries.

Technical Plan:

We are approaching the UPI (Unified Payments Interface) using blockchain technology. Unified Payments Interface (UPI) is essentially a single platform that merges different banking services and features under one umbrella. With a UPI-enabled bank account, you can simply create a UPI ID that can be used to send and transfer money. You can make real-time bank-to-bank payments, and even transact using NID number, mobile number or Virtual Payment Address (UPI ID).

The interoperable partners will be connected through UPI ID and it will be unique for individuals. The technical structure is based on blockchain to keep all data secure and unified.

Digital KYC through UPI

UPI works on a common layer or a unified interface developed and hosted by Bangladesh Bank with Support of Bangladesh Election Commission. This common layer orchestrates transactions and ensures settlement across bank accounts using NID verification. Banks, financial institutions and other entities that provide UPI services connect to the Bangladesh Bank’s unified interface through standard APIs to enable transactions from Virtual Payment Address avoiding the need to share account details or credentials. In UPI solution, payment authentication and authorization are always done using the personal phones. Since this layer offers a unified interface, any-to-any interoperable payments can be accomplished using a standard set of APIs. All APIs are exposed as stateless service over HTTPS using XML input and output and all entities consuming UPI services must ensure idempotent behavior for all APIs. These APIs are asynchronous in nature meaning once the request is sent, the response is sent back separately via corresponding response API. This allows the response to the API call to return to the caller immediately after queuing the request. All request-response correlation must be done via the transaction ID set by the originating point. Callers are expected to call the API with a unique transaction ID for which response is sent via a response API exposed by the caller. This allows the same APIs to be used for instant payment as well as delayed payments. This also allows APIs to scale without having to wait in a blocking mode. There is a set of standard APIs exposed to various participants of the UPI ecosystem key. A set of financial and Non-Financial transactions can be done using these APIs. Apart from transactional APIs, there is a set of Meta APIs to ensure that the entire system can function in an automated fashion. These Meta APIs allow PSPs to validate accounts during customer onboarding, validate addresses for sending and collecting money, provide phishing protection using white listing APIs.

When the user wants to create a bank account or mobile banking account, he/she must complete the information required to generate the UPI number. The UPI number will be unique and it can be used for other bank issues even different bank account opening as well as for MFS and DFS. Using this UPI number users can transaction funds and financial information. To activate a stronger AML system we need to implement UPI in both MFS and DFS platform and it should be activated under Bangladesh Bank’s Regulatory policy and guidelines.

When the request got any financial institute using UPI number the system is hit to the directory service to verify the request and bank other information to capable of the request. After verifying, the system got the layer of transaction settlements.

In this process, all transactions will be verified using Blockchain technology. The expected output can be huge. We can use this system to verify the users in a single click. The existing system is too time-consuming for users and for the organizations. Organizations are facing work force issues as Bangladesh is still using some manual process. But the proposed solution can be different. At present CIB takes three or four days to complete the verification process for opening a bank account and there needs lots of paperwork, which will be automatic in our proposed solution. The system also needs just one-time verification of customer and after that; UPI number will be the individual identification. This unique id is can be used for asset verification for load or others’ needs. Using this id, any authorized vendor will get the customer information according to Bangladesh Bank Regulations.

The Blockchain has a complex functionality wherein digital records combine into blocks, and such blocks make a chain cryptographically and chronologically connecting network with each other through sophisticated mathematical algorithms. Each block has a unique set of records with a connection to the previous one. Any new block is added to the end of the blockchain only. As per the study performed by Association of Certified Fraud Examiners, “typical organization loses five percent of revenues to fraud each year.” Our proposed solution also capable to find out the fraud.

Challenges

The challenge of creating interoperability consists of the need to define and enforce a common set of rules and standards, both in the technical and legal realm. A common switch, with its own set of rules for participation, technical and operational issues, improves coordination and customer experience, and allows for much faster implementation of interoperability, as compared with private switches or bilateral agreements. A set of clear rules is essential to create trust in the mobile money network. At the same time, care should be taken to leave the necessary flexibility so that new technological developments can be taken into account,both at the design stage and later at the operating stage.

Firms with a strong first-mover advantage, due to an early start and significant investmentsin rolling out their agent network, are understandably reluctant in opening their network of customers to the small competition, as this reduces their competitive advantage. This need to be settle down using regulatory rules initiate by Bangladesh Bank.

This article is written by Imran Fahad who is the Executive Director of FamaCash. He can be reached at imran.fahad@famacash.com.