The age of women being cooped up within the four walls of home is long gone. There is not a single avenue left in today’s world where women didn’t make their mark. Let it be kitchen, education, sports, business, politics or space; women have conquered all. Even in a country like ours with chauvinistic perception and conservative values, women’s participation outside home have increased significantly.

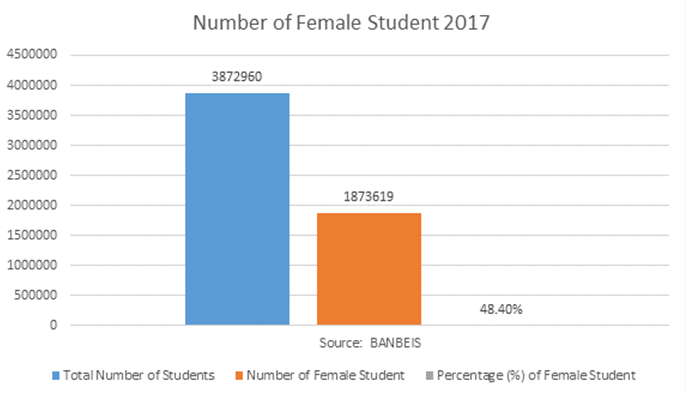

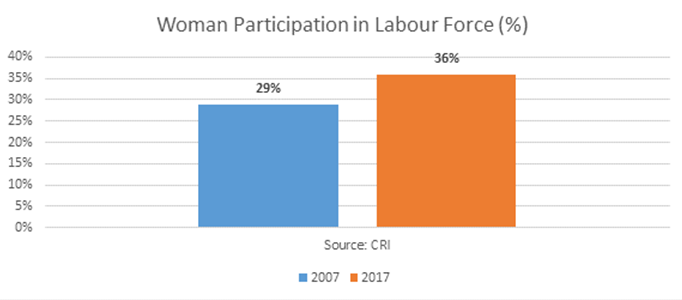

For example, female students account for 48% of total students in Bangladesh. (BANBEIS, 2017). Moreover, the labor force participation of women in Bangladesh have increased significantly over the last decade, which was 36% in 2017. (CRI)

However, breaking the chains of chauvinism and making their mark outside home have exposed today’s women to a lot of risks which is exclusive to women only, such as, road bully, eve teasing, rape etc. Over the last decade (2009-2019), number of rapes have increased more than two-fold (odhikar, 2019), which is a clear indication of a steep rise in the social risks exclusively faced my women.

Insurance is the conventional instrument that has been in use since the dawn of modern civilization to protect against risks and uncertainty. It plays a vital role in economic development and stability by helping individuals and families manage risk and deal with uncertainty. When we went on searching the insurance schemes catering to the needs of women, we were kind of dumbfounded to realize that there is no insurance scheme in our market catering to women, except for one. We will introduce you to that one and only unique service in a while.

Given the stable rise in the labor force participation of women, it’s apparent that women are at the forefront of economic development in the Bangladeshi society, representing not only an engine for growth but a large potential market for insurers. Banking on this, Green Delta Insurance Company Limited (GDIC), the largest non-life insurance company of the country, has come up with a very unique product – Nibedita, which can be dubbed as not only an insurance policy specially designed for women, but also as a superb package that deals with the wellbeing of the fairer gender.

Since its launch in 2014, Nibedita has already garnered praise in different quarters for its comprehensive coverage and unique offerings. Whether one is a student, working lady, working mother, homemaker or a student turned housewife, Nibedita opens its gates for women from all walks of life. According to the Green Delta officials, as of now, Nibedita has over one lakh subscribers from the cross section of the society.

As the first female CEO of the industry, GDIC’s Managing Director & CEO, Ms. Farzanah Chowdhury, was recognized as one of the ten Local SDG Pioneers by UN Global Compact in 2016 for her pioneering initiatives and contribution through Nibedita in ensuring women’s economic security and gender equality (SDG 5).

The Nibedita policy – Why is it Unique?

Nibedita, which brought Green Delta the global recognition, is a comprehensive insurance scheme for women. According to GDIC officials, Nibedita is the first and only insurance product in South East Asia that’s been solely designed for women.

At the core, Nibedita provides affordable comprehensive insurance coverage to women, while ensuring the best in class services to them. At the time of the launch, Nibedita’s insurance premium was in no means a hefty sum to add to the expenses, where net premium was Tk. 580 for per person (inclusive of VAT) for a yearly coverage of BDT 1 Lac.

Nibedita now offers three different slabs of different price ranges: Nibedita Eco – which has Tk. 40 premium per year, Nibedita Regular – which has Tk. 580 premium per year and Nibedita Plus – which has Tk. 10,000 premium per year.

Nibedita has been designed and engineered keeping the needs and priorities of Bangladeshi females in mind. Even though it’s a ground-breaking product, the core idea behind Nibedita is simple and elegant, to cater to the specific needs of women. It addresses the problem and peril faced by the women on a daily basis. It covers a gamut of needs a woman might have, starting from social security, healthcare to mental and financial needs.

Nibedita also extends its support for women by providing financial coverage for those suffering from trauma caused by acid violence, road bullying, rape and other cases of extreme difficulty that might arise from the most unexpected sources. Covering rehabilitation fees and providing women with support as they recuperate has probably been Nibedita’s greatest objective. In doing so, Green Delta not only acknowledges the severity of the situation, but also assures women that the company has faith in their ability to get better and will assist them both psychologically and financially to regain their ground.

Nibedita App – An One Stop Platform for Women’s Needs

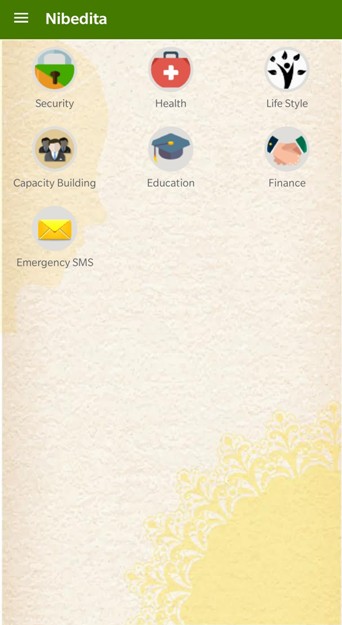

To cater the increasing need of Nibedita’s growing subscribers, GDIC launched a comprehensive app of the same name in 2016. The app is built upon the state of the art technology and has already been downloaded for thousands of times.

When Green Delta launched this dedicated app for Nibedita policyholders back in 2016, the complimentary and free app came with a host of valuable built in features designed to benefit women specifically. The dimensions covered in the Nibedita app range from health, security, lifestyle, counseling, education and finance, thus incorporating all areas of social and professional needs of a woman.

These features not only helps the policy holders to avail the services of Nibedita more easily, but also helps women to be self-dependent by providing a wide array of value added features.

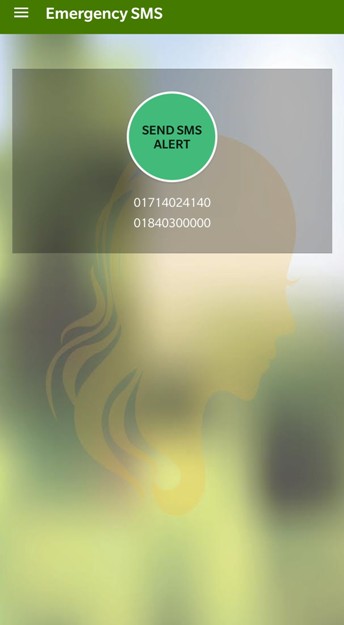

One of the main highlights of the app and a very crucial feature is the panic button, which attempts to make life safer for women through ensuring their social security. This panic button within the app is to be pressed whenever the client feels unsafe. And it will then immediately send her GPS location to the friends and family and to Green Delta’s security partner itself and help will reach to her location soon to secure her against anything or anyone that might jeopardize her social security. A major problem faced by women is thus successfully addressed by the Nibedita app.

The Nibedita policy therefore not only provides financial relief in times of trouble but also creates a pathway for women to move forward through guidance and proper support. Besides, helping with training and education, Nibedita extends its hands towards its policyholders by providing access to loan through partnering banks and financial institutions at a lower interest rate. Not only that, the lifestyle section of the app provides policyholders with up to 40% discount at different partner shops and outlets. Equipped with a number of such impressive features, the app thus acts as a one stop solution for women by saving their valuable time and energy which the customers would have spent otherwise researching on various sites.

With such a ground breaking insurance scheme in the horizon, no woman is helpless now. With Nibedita, not only women’s social security is ensured, but also their health is insured besides catering them with different value added services like loan financing, access to training and education for capacity building and skill development and last but not the least, discounts at lifestyle stores.

To avail this fantastic policy for yourself or your loved ones, you can click on the link (http://personalaccident.green-delta.com/Enrollment.aspx?Mid=qc3qymrgbZc=) or scan the QR code:

If you have already purchased the policy, please go to SMS option of your phone, type “nibedita” and send to 26969 or call 16457 to get the Nibedita App and avail exciting value added services and offers from different partners of Nibedita.