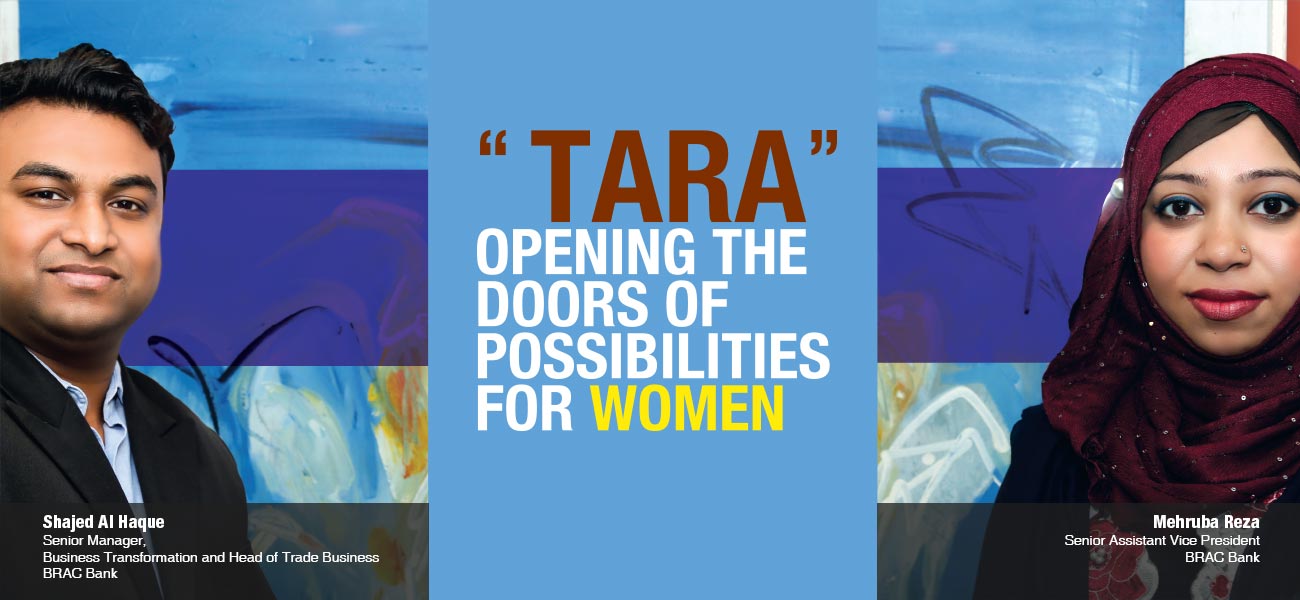

Senior Assistant Vice President of BRAC Bank Mehruba Reza and Senior Manager, Business Transformation and Head of Trade Business Shajed Al Haque caught up with Fintech to talk about BRAC Bank’s new product, TARA – a comprehensive women-focused product in the banking industry that has been designed to provide women banking solution to inspire and empower women to reach their potential.

Launched exclusively for women in 2017, TARA aims to boost women’s self-esteem and enhance their decision making power through better banking solutions that meet the lifestyle requirements of women in different segments. Retail and SME are the two sections of TARA. Senior Assistant Vice President, Mehruba Reza and Senior Manager, Business Transformation and Head of Trade Business Shajed Al Haque looks after the TARA proposition.

Fintech: Please tell us briefly about TARA.

Mehruba Reza: Women entrepreneurs in Bangladesh have predominantly been engaged in the industries like boutique, fashion, parlor, food and handicrafts. Today however, we are witnessing them striding into new business areas, for instance – manufacturing, hospitality, dairy, light engineering, etc. It has grown reasonably easier for them to market their products and services using different social media platform – particularly facebook and instagram. With the potential they hold, it is only a matter of time for women entrepreneurs to become a powerful force in the Bangladesh economy.

BRAC Bank values the undeniable role of women in society and introduced “TARA” in May, 2017. The rationale behind TARA is to encourage women customers to choose BRAC Bank as their main banking platform. All TARA products and services are arranged in a way that can benefit any woman.

Tell us about the Retail Section of TARA?

Mehruba: TARA focuses on making it easy for female customers to bank at branch premises. It offers them preferential interest rates and product features on retail loans, higher interest rates on savings accounts, special monthly deposit schemes, and platinum credit cards (for all income groups). In addition, various training opportunities are provided for their personal and professional development under its ‘Networking and Capacity Development Activities’. TARA customers get cash back on groceries purchased with their debit card every month. Furthermore, they are eligible to receive exclusive discount offers at various merchants, especially those specifically serving women’s needs.

What are the special features of TARA Deposit Products?

Mehruba: As I have mentioned earlier, higher interest rates are offered to women along with cash back facilities on groceries purchase – something that no other bank in Bangladesh has at this moment. We have numerous restaurant and merchant partners allowing our TARA customers to get unbelievable offers and discounts using their cards. Senior citizens, who are TARA customers, receive insurance benefits with special discount cards from MetLife.

The idea is to tap into the lives of thriving women’s business network and bring them under the sphere of the banking system. Under the stewardship of Selim R. F. Hussain, our Managing Director and CEO, we were able to successful in bringing 200,000 female customers within the financial inclusion ecosystem. ‘TARA Banking App’ is going to be launched officially on the 7th of March 2019. It will exclusively be a women-centric mobile banking service for our female customers. A dedicated helpline for TARA customers is also in the pipeline as well. Two desks – TARA Cash Counter and TARA Service Help Desk – are specifically placed in order to serve our TARA customers better in all the 186 branches of BRAC Bank.

The TARA Women Banking platform is the first from Bangladesh to be recognized by the Global Banking Alliance for Women (GBA). GBA is a US-based network of financial institutions and nonprofits that prioritizes banks across the world and set an example in the female financial market. Since its launch, TARA has been named Women’s Market Champion in 2017 under the innovation category and 2018 under the engagement category. I have also attended a panel discussion on “Up-skilling Women Entrepreneurs” at the World SME Finance Program where we talked about our remarkable progress during these two magnificent years.

You have worked in multinational banks like HSBC and Standard Chartered. Afterwards you joined a local bank. Do you find any difference in the corporate environment with these banks?

Mehruba:

Having worked in different corporate cultures, the only difference I feel between the local and foreign banks is that employee freedom is not restricted or limited in the local banks and hence, there is greater scope for an idea to be evaluated or implemented as opposed to the foreign banks (because of certain rules and regulations).

Employees are the main stakeholders of BRAC Bank and I really feel connected to this organization. I am a kind of person who does not believe in a predictable work routine. I enjoy coming to the office in the morning with a lot of excitement and passion.

Why is TARA Cards different from other regular cards?

Mehruba: TARA is not just a card-based product. It has deposit account, savings account besides debit and credit cards. As I have mentioned earlier, we consider all women to be eligible for TARA Platinum Credit Card customers. As far as debit cards are concerned, the yearly fee is usually imposed from the beginning of the year. However, Annual fee for TARA Debit Card holders is waived 100% in the first year. 30% lifetime annual fees is waived for all TARA Credit Cards customers with an additional 10% discount if the cards are bundled with retail loan products. Discounts on Credit Card is not rare in the industry, but you will hardly see any debit card offering discounts on annual fees – something you will see uniquely for TARA customers.

Earlier you mentioned that you will launch the mobile banking app soon. Can you tell us something about that?

Shajed Al Haque: BRAC Bank will be the first and only bank to launch a mobile banking service exclusively for women. When we launched TARA, we made a commitment to bring a mobile banking app that will contain a number of value propositions for women. After going through a lot of designs, changes and experiments, the app came into being. It was created based on the TARA theme of BRAC Bank. Offers such as healthcare service from Tonic, Telenor Health, benefits from Persona Beauty parlor for women and 30 percent discount at Sara Resort for the month of March, 2019 will be incorporated with the app. Customers will also get assistance for trade license, TIN certificate, tax return, VAT, etc. They will also be able to avail home loan, personal loan, car loan products from this app along with all the product related information and get internet banking services.

There is an option called ‘Partner’ that allows customers to shop online as well. The app will provide information and notifications on discounts, allow customers to make calls, business support, travel packages, etc. ATM locator will also be incorporated in the app.

Why do you think we see more men than women in the corporate or banking sector?

Shajed: In essence, women still don’t have the same opportunities to progress in the workplace as men. However, we need to start invoking changes with the next generation and encourage more female leaders from other sectors to begin careers in the corporate arena.

Mehruba: BRAC Bank recognizes the significance of having women in leadership positions. It makes good business sense and ensures future prosperity. Currently, we have the highest number of women employees in the industry. Out of 6,500 employees 1,100 are women at BRAC Bank. I believe we can see a big increase in the number of women employees across the corporate sector in the next few years.

Can you tell us something about the program you intend to hold in March?

Mehruba: ‘BRAC Bank TARA Awards 2019 – Realizing Potential’ is an event where women entrepreneurs are going to be recognized for their achievements. 170 women entrepreneurs were nominated from 186 BRAC Bank branches, out of which six women (from six different categories) will be selected for the awards. A panel of independent, external judges – Farzana Chowdhury, CEO of Green Delta Insurance limited, Shwapna Bhowmick, Country Manager of Marks and Spencer and Sutapa Bhattacharjee, Associate Professor at IBA – will be deciding on the shortlist prior to the event.

Shajed: There is no recognition for the small entrepreneurs in the SME sector. We feel this will be a very good women entrepreneurs’ recognition platform and will eventually inspire others as well.

Tell us about the SME Section of TARA?

Shajed: BRAC Bank Limited began with the vision to provide banking solutions to the ‘unbanked’ Small and Medium Entrepreneurs. Taking inspiration from its parent organization BRAC, the largest NGO in the world, BRAC Bank introduced small ticket loans to the small and medium enterprises (SME), to specifically bring the grassroots entrepreneurs under the umbrella of formal banking service. Approximately half of BRAC Bank’s lending portfolio comprises of small and medium enterprises – popularly known as the ‘SME’.

Now we have the largest portfolio of unsecured loans in Bangladesh. Our SME business stands around 10,000 crore, out of which nearly 80 percent is unsecured loan. We have given unsecured loans without any collaterals – starting from BDT 3 to 4 lac and up to BDT 1 crore. We began disbursing loans to women since 2003. Before the launch of TARA, our portfolio was around BDT 150 crore. After the introduction of TARA in the industry, BRAC Bank has managed to double its portfolio in one and a half years. As Bangladesh graduates to a developing country, TARA aims to play a significant role in bringing women into the mainstream financial system. TARA already has almost 3000 women SME business customers and more than 250,000 deposit customers.

The government of Bangladesh has approved three more banks. Do you think the banking sector is becoming over-crowded?

Shajed: Well it is a matter of concern when you look at how many banks we have in Bangladesh and the number of people who are under the purview of those banks. According to the statistics of Bangladesh Bank, only 30 percent of the population falls under the umbrella of the banking system. How much market share the new banks will get from the un-banked population will depend on their strategy, and even if the banking sector seems over-crowded, they will be able to move ahead.

Names like Fintech and Blockchain have become quite popular in the banking sector. How well do you think Bangladesh has managed to adapt with the disruptions in the banking sector?

Shajed: If we talk about BRAC Bank, we are continuously working with digital transformation and financial technology related activities. We have gone abroad and seen the fintech companies there and what type of service they provide. We have learnt a lot from these overseas trips. In our case, we are fully prepared for the digital transformation. All the systems are ready to work with the local fintech and e-commerce firms as well as with the technologies we will use in the future. We have already begun working with Daraz and Bagdoom. In the near future, banks will be partnering more with fintech companies in order to provide financial services to the people.