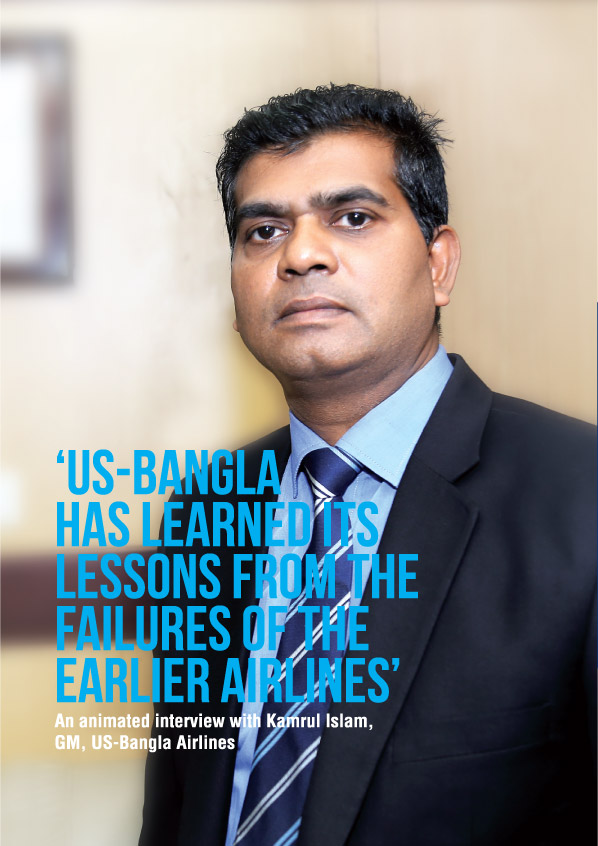

After completing honors and masters in Economics from Shah Jalal University of Science and Technology (SUST), Kamrul Islam started his career in GMG Airlines as an Assistant Manager of Marketing and PR in 1998. After working there for nearly seven years, he worked in Wind Mill Advertising for a brief period and then in Daily Jai Jai Din for two years. In 2007, he came back to the aviation industry and joined United Airways as the DGM of Marketing Support and PR. In 2015, he joined US-Bangla Airlines in the same capacity. In 2017, he was made the GM of Marketing Support and PR in the airlines.

In Bangladesh’s aviation industry, US-Bangla has become a trusted name in the last few years. The airlines started slowly, concentratd on providing impeccable services to its customers-something which the local airlines of Bangladesh are not particularly known for- and gained enough confidence to push for creating a global brnad name.

Now within three years of its operation, it has been able to start regular flights in eight local destinations and seven global destinations. Kamrul Islam, the General Manager (Marketing Support and PR) of US-Bangla Airlines is at the forefront of this successful journey. The Fintech team recently went to his office inside Baridhara Diplomatic Zone and talked with him about his career, US-Bangla and his thought on the whole aviation industry of the country.

Fintech: Have you always been in the aviation business? When did you start your career?

K.Islam: Yes, I have indeed started my career in the aviation industry. It started in December 1, 1998 with GMG Airlines. I started there as junior officer. I had worked with the airlines for the next seven years. In 2005, I switched my profession and went into the media industry. I joined the newly launched Jai Jai Din newspaper and worked there for the next two years. In 2007, I again got back to the aviation industry and joined United Airways. After working there for the next years, in October, 2015, I joined US-Bangla Airways. Recently, I was promoted as its General Manager.

Fintech: You have worked in both GMG and United Airways for a number of years. Both of those airlines have stopped their business operations. What went wrong?

K.Islam: The aviation industry of Bangladesh has witnessed a lot of vicissitudes. I have over 17 years of experiences in this industry and I can tell you that the airlines which were compelled to pull plug into their operations were all put into that sort of situation because of their own faults. Their failures were a result of some related issues like miscalculated operational cost structures, noncompliance with service excellence as per the international standard of aviation industry and faulty routes and aircraft choices.

When GMG Airlines started its operation in 1997, it was well received by the passengers. They were happy with the services of the airlines. GMG even bought Boeing 747. But the airlines failed because after a certain period it failed to maintain its service standards. There were regular flight delayes. You have to understand that airlines industry is primarily a service industry and continouslly delayed flight is basically the death knell of an airlines. When a passenger buys an air ticket with hefty amount of money, s/he expects to be ferried to his/her destination on time.

That’s basic. GMG failed to stay true to that basic. Same happened with the United Airways as well.

Reputation is a big thing in the aviation industry and it takes a lifetime to build a reputation but all it takes is a moment to destroy the life’s work. In the aviation industry, there are very few margins of errors. This is because it is a highly competitive industry in where you are competing with the global operators. If your fail to take your passengers to their destinations on time, it will hurt your reputation and eventually your business. There is another problem with aviation industry. Since it involves big money, when an airlines go down in the business, it doesnlt necessarily mean that ‘it’ reduces down to zero, rather it goes into ‘minus’. If your look at GMG or United, then you will see that they are out of the market with big debt. That’s the challenge of the industry.

Fintech: In Bangladesh, there were some other airlines which started their operations but eventually stopped within few years? Do you think they had the same problem too?

Fintech: In Bangladesh, there were some other airlines which started their operations but eventually stopped within few years? Do you think they had the same problem too?

K.Islam: Pretty much so. Airlines like-Air Bangladesh, Air Parabat, Best Air, Aviana Airways, Zoom Airways, Aero Bengal, Mid-Asia Airlines, Royal Bengal Airlines, THT Air Services and Voyager Airlines Bangladesh have all started their business but went out of the market because of the same mistakes. Opening an airline doesn’t mean acquiring a license, buying few aircrafts and starting operations. You have to have skilled manpower, trained cabin crews and above all strong determination in maintaining service excellence.

Fintech: Do you think those closed airlines have put an impact on the industry?

K.Islam: Of course. When you have repeated cases of failures, then it hurts the whole industry. Aviation industry is a capital intensive industry and you need to raise big fund to start an airlines. In Bangladesh, you usually raise the funds from the banks. Now when the banks see that there are number of failed cases in this industry, naturally they feel reluctant in disbursing loan. Besides, it creates a disruption in attracting able manpower in the aviation industry. GMG closed down after operating for 14 years, and United Airways closed down after 10 years in operation. If we take these two airlines as examples, these two companies must have had over a thousand staffs before they closed down. When these companies were shut down over night, the lives of their employees were put into serious peril.

After 14 years when people’s careers become uncertain, then it is very difficult to have any faith for that sector. I studied economics and I certainly had a lot of career opportunities. The banking sector was open for me, at least. I chose airlines over that 19 or 20 years ago. It was understood and appreciated to be a sophisticated profession. Qualified people entered this sector. Globally the aviation trade is ok. That was the basis for my choice. But as time was passing I started to feel as if the sector is a little uncertain. That is because of the failures of those earlier airlines.

Fintech: So what has US-Bangla done right? How does it able to attain success in an industry which has witnessd repeated cases of failure in the last two decades?

K.Islam: First of all, I can tell you that the US-Bangla has learned its lessons from the failures of the earlier airlines. It made its entrance into the marlet with a proper game plan. It identified the key areas of the airlines industry where it needed to concentrate-like scheduling of flights, maintaining time and ensuring service excellence. US-Bangla has also made its decision of expanding its number of routes slowly and wisely. The decision of purchasing new aircrafts to expand the fleet is also made through rigorous fact-checking process and decision making process.

Let me give you some facts. Since US-Bangla started its operation back in July 17, 2014 with a Dhaka-Jessore flight, it has maintained a 98.7% on-time performance. I think this maintenance of time has been instrumental in our success in quick time. People now know that when they purchase a ticket of US-Bangla, they are almost guaranteed to be ferried to their destination on time. This is very important especially for the domestic market because in the domestic market the people who are taking flights are usually making that choice to save time. So reaching them to their destination on time is of paramount importance.

Besides, our in-flight services have already garnered praises from the passengers. All of our cabin crews are selectd through competitive processes and they all have gone through extensive training processes. We have our catering services in where we prepare quality healthy meals after consulting with expert nutritionists and chefs. We also have some services which airlines don’t have. We have started picking up our business class passenger from home. We have also opened ‘wage earner’ desks in the airport. These desks are helping the first time passngers and the passengers in need of filling up airport forms. A good number of our passengers in our Middle Eastern countries route are the wage earners and they usually get daunted when they arrive in the airport. We address their discomfort and to make things easy for them, we have opened these wage earners desk.

Our luggage delivery service is also of top-notch quality. We have our own staffs in the airport and we usually deliver the luggage in the conveyer belt from the aircraft within 15-20 minutes. Our impeccable luggage services have helped us to gain a good reputation too.

Fintech: What is the current fleet size of US-bangla? On how many routes it has been operating now?

K.Islam: Currently the size of our fleet is seven. US-Bangla Airlines operates four Boeing 737-800 aircraft and three Dash 8 — Q400 aircraft. In domestic routes, it is operating flights in all eight airports across the country. Those are-Dhaka, Chittagong, Cox’s Bazar, Jessore, Sylhet, Saidpur, Rajshahi and Barisal. In international routes, it operates in kathmundu, Muscat, Kolkata, Kuala Lumpur, Singapore Bangkok and Doha. It plans to start operating in other destinations like Hongkong, Riyadh, Jeddah, Dammam, Abu Dhabi, Chennai and Delhi soon.

Fintech: US-bangla is obviously doing well. But what are the challenges that the company is facing to run its business?

K.Islam: Yes, US-Bangla is doing well but the responsibility of doing well is not only with the company. The responsibility also falls on the regulatory authorities and decision makers at the ministries. Our operation cost has increased quite a significant amount. Airfare is directly related to that, needless to say. Where are you going to get back your increase operation costs? It has to come from the airfare, which falls directly on the passengers. If you can reduce the operations cost, then you can keep the fare low and there will be less pressure on the passengers. That will lead to growth of the number of passengers. All of these are interconnected.

The cost increases have been on the fuel cost, aeronautical and non-aeronautical charges. Who are deciding on the amount of these charges? The Civil Aviation Authority of course. Besides, jet fuel is a monopoly business by Padma oil in Bangladesh. Since it is not a competitive market, there has to be options. Now, there are two rates; one for international operations and another for domestic. Ironically, the rate for domestic operation is higher than international operation. Private carriers start their businesses with domestic. You cannot switch to international before operating domestically for a year. If the fuel price is subsidized, at least for the starting period of private airlines, let’s say two or three years or even five years, if you do that, exempt all the taxes and VATs, then a private airlines coming into the market with a huge investment, can use this assistance to establish its business.

There are aeronautical and non-aeronautical charges. Non-aeronautical charges include, for example, I took a space from the Civil Aviation Authority, there’s a charge for that. There are charges for checking counters, engineers’ office and things like that. These charges are very high. The aeronautical charges include things like landing, parking, security charges. There is also discrimination here. The charge for landing a plane from an international to a domestic station is three or four or five times more than landing a domestic to domestic station. This shouldn’t happen. When we land a Boeing aircraft, which has a certain weight and configuration, at the Chittagong airport from Dhaka, the charge for the landing is calculated according to the weight and the capacity. When the same aircraft lands at the Dhaka Airport from say Bangkok, the charges are four or five times higher. Why I should incur that? I am a Bangladeshi carrier and I am landing the same aircraft. On one instance we are being treated as a domestic operator and another on another as an international.

Who is going to solve these problems? Obviously, it should be the regulatory authority. As I know, there has been many communications in between the two, private airlines sent letters on many occasions to the regulatory body to reduce the charges in the last 20 years. But we haven’t gotten satisfactory responses.

Another matter I want to touch on, a calculation regarding aeronautical charges, when we land an international flight we have to incur charges on the international rate until that plane flies off to another destination. My point is, I am a Bangladeshi carrier. I was given license by the Civil Aviation and the Bangladesh Government. It’s just not right to charge me like international carriers. For example, let’s say a Saudi Airlines flight landed here. It stayed for an hour and then left. You can charge that on the international rate, it stayed for just an hour. When I land my next international flight is typically after six hours. As a Bangladesh carrier, all of my charges should be like domestic charges. Only then we can survive, otherwise it is very difficult. We can only serve our customers if we can survive. I cannot serve you if I am a losing case. In order to prevent me from failing there has to be support from the regulatory body.

In a country like Bangladesh we are giving subsidies to many organisations, aren’t we? Aviation industry is a vital industry. It is very important for developing the brand value of your country. When one of our aircraft lands abroad and people see it’s a plane from Bangladesh that certainly lifts the image of the country. ■