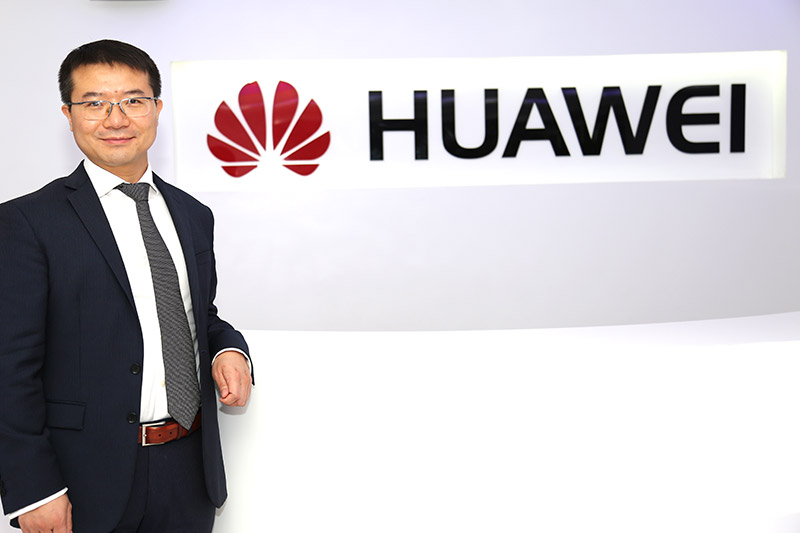

Leon Xia was appointed and posted as the COO for Huawei Bangladesh in July this year. Exuding graceful Chinese politeness, Mr Xia met with the Fintech team in the midst of a big media outreach day by Huawei, where the COO was scheduled to give interviews for a number of Bangladeshi newspapers and other media outlets.

Apologizing for keeping us waiting, Mr Xia sat down with us in a state of the art conference room, which was fittingly equipped with wall to wall screen for live video conferencing. As we reassured the Huawei team about keeping within our designated time, the newly appointed COO said to us, “I would also try to give you straight forward and precise answers.”

Leon Xia’s impressive ease in talking to the press undoubtedly comes from his long experience in the profession, but it also comes from a genuine interest in and a love for what he does, as became clear during the very engaged interview. We pelted him with questions about as many pertinent topics as we could, including Cloud, Big Data, AI, MFS, carrier, solutions and more. And as promised, we got relevant and precise answers. Here is the interview for our readers:

FINTECH: Could you tell us where your career started and what led to this point?

LX: My story is probably much simpler than most professionals. I graduated with a masters degree in 2005 and then I joined Huawei. At first I worked as a management trainee for about eight months. After that I became the manager for sales in Saudi Arabia. Shortly afterwards I was made the key accounts manager. I worked there for seven years, working all the way up to the vice president of Saudi Telecom global key account by the year 2013. During this period, I worked in every possible area in Huawei’s business; the carrier business with a wide range of product portfolio including radio, IP and IT. I also dealt with some enterprise portfolio. I managed the device business as well.

After that I took on some very challenging role, to work with Vodafone globally based in the UK, as a business director, IT and the Cloud. So it was basically about digitalization and cloudification. I faced the most advanced and technically demanding customers. I was there for four years. Before (that time) we were not recognised as a cloud player, rather we were known more as a network player. As I approached the completion of my assignment, we were being gradually esteemed as a cloud partner by Vodafone.

After that I was relocated here in Bangladesh. So, that’s how I experienced different aspects of the business, including the business management role, the business development role, the solution head role and also the marketing role. So, that’s how I’m here.

FINTECH: Is there any particular reason why Huawei posted you here? There must have been some sort of vision regarding your role in this country.

LX: Nobody told me what exactly to do here. But we do have a vision, that is as a proactive participant in the ICT sector; at least what I tell myself is that when I leave I want to see a very different ICT sector in Bangladesh, with Huawei as a significant contributor to that end. Because here is a very promising market with a lot of talents and lot of possibilities, and what we want to achieve is to unleash the potential of the economy and the society through digitalization, and pave the way to improving the ICT infrastructure here. And also we are working closely with our customers, who are as much visionaries (as we are) and committed to bring about changes to the marketplace. I also see a lot of potential in almost every area, like in carrier business, in enterprise, and as well as in the consumer devices.

LX: Nobody told me what exactly to do here. But we do have a vision, that is as a proactive participant in the ICT sector; at least what I tell myself is that when I leave I want to see a very different ICT sector in Bangladesh, with Huawei as a significant contributor to that end. Because here is a very promising market with a lot of talents and lot of possibilities, and what we want to achieve is to unleash the potential of the economy and the society through digitalization, and pave the way to improving the ICT infrastructure here. And also we are working closely with our customers, who are as much visionaries (as we are) and committed to bring about changes to the marketplace. I also see a lot of potential in almost every area, like in carrier business, in enterprise, and as well as in the consumer devices.

So, we hope that in a few years, we continue to be ICT leader and be a significant contributor to the digital Bangladesh vision by 2021. At that point I might consider my next post, probably.

FINTECH: You provide network solution as well as the hardware/devices. Do you think you have an extra edge because of that, meaning when your equipment work with your network?

LX: No. What I would say is that device is relatively independent and separate. Otherwise it is hard to explain the success of Apple, who don’t have a network offering. But it does provide us with some special advantages. When we cater to a customer’s needs, for example, we are one of the best experts in radio network, which interacts with devices; so, for accuracy and for the interface and for all the standards we understand how devices can seamlessly work with networks, not just by Huawei, but networks that follow the same standard, whether they are 2G, 3G or 4G.

FINTECH: Could you tell us about Huawei’s plan for mobile financial solution, particularly your work with bKash?

LX: Ok, first of all, our general goal is to be the key enabler to the digitalization by carrier, by enterprise and the society in general. So, mobile finance solution is quite a key component. So far, the two operators which are the top in mobile money offerings are bKash and M-Pesa in Kenya. Huawei is the supplier for both.

LX: Ok, first of all, our general goal is to be the key enabler to the digitalization by carrier, by enterprise and the society in general. So, mobile finance solution is quite a key component. So far, the two operators which are the top in mobile money offerings are bKash and M-Pesa in Kenya. Huawei is the supplier for both.

I think our partnership here with bKash demonstrates our commitment to the digitalization role. This is a fine example of a better connected and more efficient ecosystem, in which people can do things much more easily and which has many choices for all. What we want to achieve is to design our platform as a flexible and open platform as much as possible, and to allow bKash to interact with a different partnership to the end users side, to the partners’ side. So, if you take a look at the topology, it’s like North bound interfaces, South bound interfaces, and everything will be open API to accommodate other participants in this business. Mobile finance solution is not just about technology. It’s technology slash ecosystem. That’s why from the very beginning we worked toward a more open world. And this mobile finance solution also exemplifies how we work in other fields, like utility, finance, education, public security etc. We would provide the ICT components and the platform as the core enabler. But, you know, we work together with our partners to accommodate every kinds of possibility into that. So, it’s not just about Huawei’s success, it’s about the vision of a digital Bangladesh. And also for our conventional carrier business digitalization needs to take place. The network is going to be more and more software defined and also cloud defined. It is very important for us to work with our customers to carefully define the architecture as well as the operational mode for the future.

For enterprise what we want to achieve is to enable our distribution channel and our partners, because it’s a vast market with a lot of potential customers. So, we will heavily rely on our partners to extend our reach to this marketplace. Also we want to continue to be recognised as the preferred brand in the consumer market with our smart devices, especially when 4G is coming. And the penetration is quite significant already; even now (it is significant) before 4G. And I think later on people will enjoy the facilitation and the ease that can be delivered by the next generation technology and good quality devices. This is basically our overall vision.

FINTECH: What is your approach to some of the new revolutionary technologies such as Big Date and AI? How do you prepare to integrate those into your ecosystem?

LX: I think our vision is still to be the enabler, because data is actually a very core asset to many of our customers. For example, carrier; operators possess very large amount of user data. They store this data. First of all, this is our customers’ data, not our data. We help our customers monetize this data, instead of monetizing for ourselves. This is not our pursuit.

With more flexibility and openness in the architecture a lot of different components, which cannot talk to each other, will be seamlessly connected to generate approachable dataline. By leveraging some of the open API standards like Hadoop and some other big data platforms we would help out our customers with our analytic assistance. We would focus on the key infrastructure layer to make this platform open, to make it possible to aggregate all kinds of data and make it available for years. This is our big data vision. We are not possessing the data, but we will help our customers in processing the data.

You also asked about AI. AI is very important for almost every technology and we are not exceptional. AI means we can standardize some things with defined logic. Now AI is not completely replacing human beings in most areas.

FINTECH: It’s basically a lot of automation at this point…

LX: Yes, a lot of automation. So, the cognitive part is handled by humans. But a lot of automation can be done with AI, as you said, especially in the operational area. And, you know, operators usually have large assets to take care. Many problems will be incurred here and there due to different reasons. A lot of these can be controlled using AI. So, going forward what we want to do is to increase the presence of AI in our tool and work process, so that we can help our customers handle the problems more efficiently. And also we want to make our gears more and more intelligent. So, once they are programmed to be more and more intelligent, maybe we will see something like self-healing and higher resilience. Now they don’t talk to each other intelligently. But they will. So, this is our vision for AI.

as you said, especially in the operational area. And, you know, operators usually have large assets to take care. Many problems will be incurred here and there due to different reasons. A lot of these can be controlled using AI. So, going forward what we want to do is to increase the presence of AI in our tool and work process, so that we can help our customers handle the problems more efficiently. And also we want to make our gears more and more intelligent. So, once they are programmed to be more and more intelligent, maybe we will see something like self-healing and higher resilience. Now they don’t talk to each other intelligently. But they will. So, this is our vision for AI.

But you have to respect the human part as well, because it is always very cautious decision to be made for the AI part. It takes quite a long time to prove certain AI technology and put it into induction. You also need to take into consideration the organizational part. It’s a gradual evolution. It’s comes from dialogues with our customers and among ourselves. I think these factors together will define the pace of AI introduction. I believe Big Data comes first, because without the processing and analyzing of the data it’s not very likely to have a very efficient AI application. We need to make better use of the data, then a lot of problems will be solved. Then if you want to go past that the AI part will follow.

FINTECH: We just had a big conference on data centre here in Dhaka, probably the first of its kind. One of the main themes was discussing if Bangladesh could become a data centre destination regionally and globally. Do you think that’s a true potential? And what Huawei’s role might be in this?

FINTECH: We just had a big conference on data centre here in Dhaka, probably the first of its kind. One of the main themes was discussing if Bangladesh could become a data centre destination regionally and globally. Do you think that’s a true potential? And what Huawei’s role might be in this?

LX: Of course. We built more than six hundred data centres globally. And also we are a leading data centre solution provider throughout almost every layer. From energy to site solution, and to storage as a computer, also virtualization; on top of that we have some past platform and selected applications, heavily relevant to our customer base, like in carrier.

We have recently built this unit as a component level called ‘Cloud BU’. So, it’s already a determined strategy for Huawei to go for this Cloud market. Data centres will be the nerve of future infrastructures for sure. And even operator’s network will look more and more like data centres as well. That’s why I think it’s very right for Bangladesh to go for a data centre strategy. This is vast market. Considering the population and potential, even to attend the domestic part only will be a big task, as it is a very huge market already. Secondly, any economy that is connected to the outside. It’s not just a strategy. More and more data centre will be a must for everything. Even behind things like YouTube and Facebook there are lots of data centres.

A lot of what we do for our customers isn’t possible without data centres. So, it will be a very important cornerstone in digital Bangladesh, at least in my mind.

FINTECH: We have covered a lot of ground. Do you want to add anything else?

LX: I think those were really interesting questions. What I want to tell the people through the media is that we grew up together with the local market and the local people. We will continue to do so. Also, we will keep upholding our tradition of putting our customer in the centre. We want to stay humble and faithful to our end users, no matter how big or how successful we are, through good and bad times. We value our partnership. We will work together with our local partners for the success of the ICT sector.

FINTECH: That’s a beautiful message. Thanks very much for your time.

LX: Thank you. ■